You wake up in the morning, check your phone, and see notifications of money flowing into your account. Sounds pretty sweet, doesn’t it? That’s the magic of passive income – It’s like having a steady flow of cash coming in, without needing a ton of effort to keep it going.

But before you dive headfirst into building a massive passive income stream, let’s take a step back. We need to make sure you understand what passive income is and how it fits into your overall financial goals.

This blog post will be your one-stop guide to navigating the world of passive income. We’ll break down the concept, explore who can benefit from it most, and set realistic expectations about the work involved. Then, we’ll delve into a comparison of some of the best passive income methods to help you find the perfect fit for your interests and resources.

Here at Maxmart, we’re dedicated to empowering individuals like you to achieve financial freedom through online passive income. Whether you’re a seasoned entrepreneur or just starting your journey, we provide valuable information and guidance, specifically focusing on the lucrative world of affiliate marketing as the best online passive income.

What is Passive Income?

Passive income is money you earn with minimal ongoing effort. It’s different from a regular job where you get paid by the hour. Passive income keeps bringing in money, even when you’re sleeping, on vacation, or doing things you enjoy.

Some ways to make passive income, like starting a popular blog or renting out an apartment, might take some effort at first to set up. But the best part is, once they’re going, they practically run themselves!

In essence, you’re using your efforts strategically to create a system that works for you, rather than constantly trading your time for income. This can be a game-changer for anyone looking to build wealth and achieve financial freedom. Passive income provides a safety net, a way to supplement your current income, or even pave the path for early retirement.

Who Does Passive Income Fit?

The allure of passive income is undeniable – the idea of earning money while you sleep sounds like a dream come true. But before you dive headfirst into the latest get-rich-quick scheme, it’s crucial to understand how passive income can realistically fit into your overall financial goals:

- Supplements, Not Replaces: Building a significant passive income stream takes time and effort upfront. It’s unlikely to replace your current paycheck immediately. However, it can provide a steady stream of additional income to free up cash flow and bolster your financial picture.

- Path to Freedom: Financial freedom isn’t just about a big income number. It’s about having your expenses covered and enough left over to pursue your goals. Passive income adds another tile to your financial foundation. Even a modest passive income stream can significantly reduce the amount you need to earn from your primary job, bringing you closer to that feeling of freedom.

Imagine you have a rental property generating $500 a month. That’s $6,000 a year that can go towards savings, debt repayment, or simply reducing your work hours. The more passive income streams you cultivate, the bigger the financial buffer you create and the closer you get to true financial freedom.

Realistic Expectations About Passive Income: It’s Not Quite Magic

The term “passive income” can be a bit misleading. While it’s true the ideal is to earn money with minimal ongoing effort, there’s a reality check needed. Here’s what to keep in mind:

- Upfront Work is Real: Getting started with passive income usually takes a good chunk of your time and hard work at the beginning. This could involve creating content, developing a product, researching investments, or finding and managing rental properties. The amount of work will vary depending on the chosen method but understand that getting to that “passive” stage takes dedication.

- Maintenance Needs Exist: Don’t expect to set it and forget it entirely. Even established passive income streams often require some ongoing maintenance. This could involve updating content, marketing your product, managing rentals, or rebalancing investments. The key is to find a method where the maintenance is minimal and doesn’t take up a huge chunk of your time.

- Time is a Factor: Building a substantial passive income stream takes time. Don’t be discouraged if you don’t see a windfall overnight. It can take months or even years for your efforts to translate into significant income. Be patient, consistent, and focus on building a system that can grow over time.

By setting realistic expectations, you’ll be better prepared for the path toward true passive income. Remember, it’s a marathon, not a sprint, but with the right approach, it can be a powerful tool to achieve your financial goals.

Comparing 4 Best Passive Income Methods

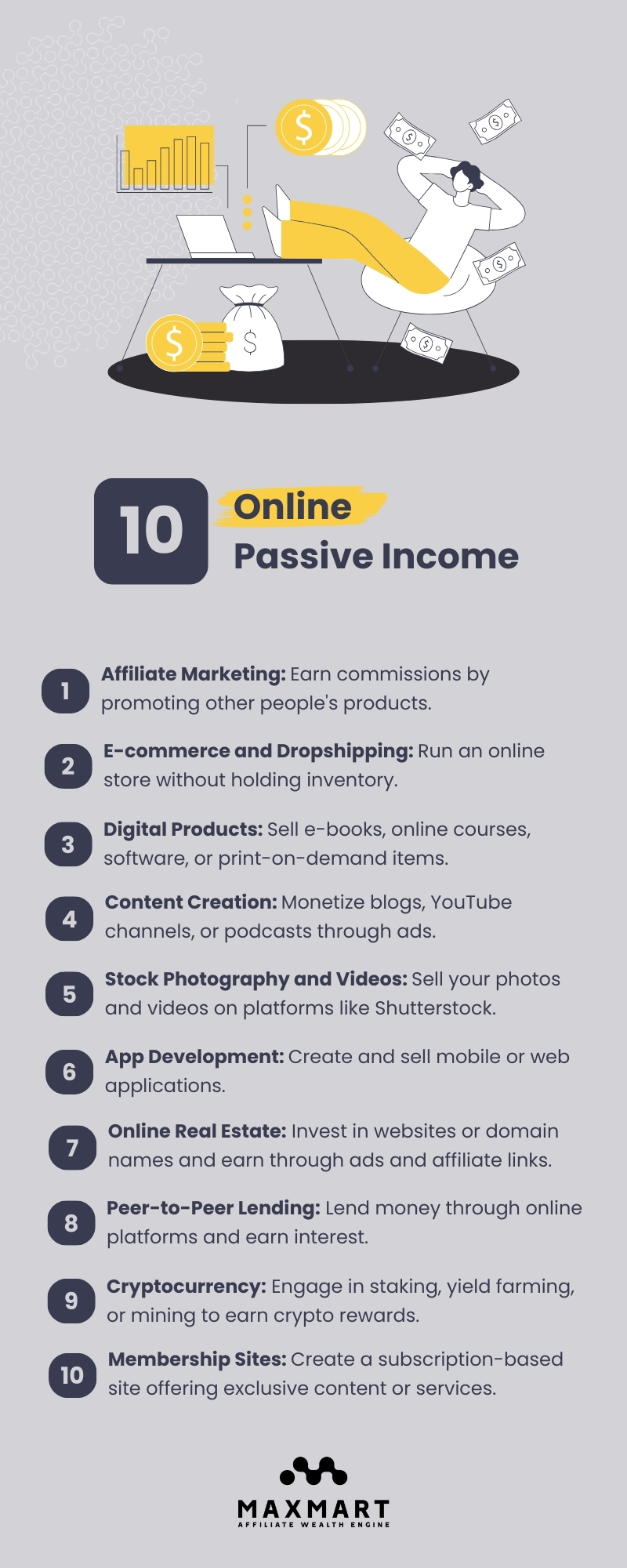

Now that you’ve unlocked the secrets of passive income and its potential for financial freedom, it’s time to explore the exciting world of methods to make it happen! With so many options out there, don’t let the sheer number of choices confuse you.

MaxMart has simplified this process for you by comparing the top passive income methods. We’ve analyzed them based on four key criteria:

- Basic Knowledge Needed,

- Initial Investment

- Time to Income

- and Pros and Cons.

This clear breakdown will help you choose the perfect method to kickstart your path to financial independence. At the end of this blog post, we will give you a list of other passive income methods, too.

1. Rental Properties: Steady Income with Hands-on Hustle

Rental properties are a classic example of passive income, offering the potential for steady returns with ongoing cash flow. Let’s dive into what you need to know:

1.1 Basic Knowledge

Rental properties require some knowledge of real estate and property management. You’ll need to understand fair market rent for your area, tenant screening procedures, and basic maintenance tasks. Familiarity with local landlord-tenant laws is also crucial.

1.2 Initial Investment

This is a big one. Rental properties require a significant upfront investment. You’ll need a down payment for the property itself, and depending on your location, closing costs and renovations can add up.

1.3 Time to Reach Income

While you can start collecting rent as soon as you find a tenant, it can take time to find the right fit and get the property rent-ready. Generally, you can expect rental income to start flowing within a few months of purchasing the property.

1.4 Pros

- Passive Income: Rental income provides a steady stream of cash flow, even while you sleep.

- Appreciation: Over time, the property itself may increase in value, building your wealth.

- Tax Advantages: Depending on the region, rental expenses may be tax-deductible, reducing your taxable income.

1.5 Cons

- High Initial Investment: Getting started requires a significant amount of capital.

- Management Responsibilities: Even with a property manager, unexpected repairs and tenant issues can arise.

- Vacancy Risks: Periods without a tenant can disrupt your cash flow.

- Illiquid Investment: Selling a property takes time and effort, unlike stocks or bonds.

1.6 Verdict

Rental properties offer a compelling combination of passive income, potential appreciation, and tax benefits. However, they are best suited for investors with a long-term perspective who can tolerate some level of risk and responsibility. The high upfront cost requires significant capital, and managing tenants and repairs can be time-consuming. Even with a property manager, unexpected challenges can arise. However, for those comfortable navigating these hurdles, rental properties can be a solid path to building long-term wealth and a steady income stream.

2. Dividend-paying stocks and ETFs (Investing)

Here’s a definition of dividend-paying stocks and ETFs:

- Dividend-paying stocks: Companies that share a portion of their profits with shareholders through regular cash payments (dividends). Investing in dividend-paying stocks offers the potential for a dual income stream: cash flow from the dividends themselves, and potential capital appreciation if the stock price increases.

- Dividend-paying ETFs: A collection of securities that trades like a stock, but invests in a basket of dividend-paying companies. This offers diversification with a single investment.

2.1 Basic knowledge

While dividend-paying stocks and ETFs can be a compelling passive income strategy, it’s important to understand it’s not a “set it and forget it” approach. This strategy requires a basic grasp of the stock market and how companies distribute profits to shareholders (dividends).

While the concept may seem straightforward, successfully navigating this area requires knowledge and research. To maximize your returns and mitigate risk, consider seeking guidance from a financial advisor or dedicating significant time to educating yourself on financial markets before diving in.

2.2 Initial Investment

You can start with any amount. While some stocks have minimum share prices, ETFs often have lower entry points allowing you to buy fractions of shares. There are dividend-paying ETFs for various budgets.

2.3 Time required to reach income

Dividends (depending on the region) are typically paid quarterly or annually, so you could start seeing income within three months of investing. However, building a sustainable income stream may take longer depending on how much you invest and how you reinvest your dividends.

2.4 Pros

- Regular income: Companies with a history of paying dividends provide a predictable income stream.

- Compounding: You can reinvest your dividends to purchase additional shares, which can snowball your earnings over time.

- Diversification: ETFs allow you to spread your investment across multiple companies, reducing risk.

- Growth Potential: While the focus is on income, some dividend-paying stocks may also experience share price appreciation.

2.5 Cons

- Market risk: Stock prices can fluctuate, and dividend payments are not guaranteed.

- Lower overall returns: Dividend-paying stocks may have slower growth compared to non-dividend-paying stocks with high growth potential.

- Taxes: Dividends are typically taxed as ordinary income.

2.6 Verdict

Dividend-paying stocks and ETFs are best suited for investors seeking a regular stream of income alongside some potential for capital appreciation. This strategy is particularly attractive for retirees or individuals nearing retirement who rely on their investments to generate income.

Additionally, investors with a long-term investment horizon can benefit from compounding their dividends over time. However, investors should be aware of the associated risks, including market fluctuations, lower overall returns compared to high-growth stocks, and tax implications.

3. Creating and Selling Digital Products (Ebooks, Courses)

Creating and selling digital products offers a compelling path to passive income. With its low barrier to entry and high profit margins, it’s an attractive option for many. However, it requires dedication, marketing savvy, and creating valuable content to stand out in a competitive marketplace.

3.1 Basic Knowledge

This path requires varying degrees of knowledge depending on your chosen product. Writing an ebook leverages your writing and research skills in a specific niche. Creating online courses might require additional expertise in video editing, presentation, or screencasting software. However, there’s a wealth of free and paid resources available online to bridge any knowledge gaps.

3.2 Initial Investment

The beauty of digital products is the low initial investment. You might need software like writing tools or screen recording programs, but these can be free or have affordable options. Design tools like Canva offer free plans to create visually appealing course materials or ebooks. The biggest investment will be your time and effort in creating the content.

3.3 Time Required to Reach Income

This can vary significantly. Creating a short ebook might take weeks, while a comprehensive online course could take months. However, the real-time investment comes in marketing your product. Building an audience and driving traffic to your sales page takes time and consistent effort. It could be several months before you see a steady income stream.

3.4 Pros

- Passive Income: Once created, your digital product can generate sales with minimal ongoing effort.

- Scalability: You can sell your product to an unlimited audience, unlike physical products with limited inventory.

- Location Independence: You can create and sell digital products from anywhere in the world.

- Profit Potential: Digital products boast high profit margins since there are no physical production or distribution costs.

- Expertise Sharing: You can turn your knowledge and passion into a profitable business.

3.5 Cons

- Upfront Time Commitment: Creating valuable content takes time and effort.

- Marketing Challenges: Reaching your target audience and driving sales requires ongoing marketing efforts.

- Competition: The digital product space is crowded, so standing out requires a unique niche and effective marketing.

- Passive Doesn’t Mean Effortless: Responding to customer inquiries, updating content, and maintaining your online presence requires some ongoing effort.

3.6 Verdict

Creating and selling digital products is ideal for individuals with the expertise they’d like to share, a knack for content creation, and the patience to build an audience. While the passive income stream is attractive, it’s not entirely effortless.

Success hinges on effective marketing to stand out in a crowded marketplace, with some ongoing effort required for customer support and content updates. However, for those with the skills and dedication, digital products offer a scalable, location-independent business model with high profit potential.

4. Affiliate Marketing

Affiliate marketing is a business model where you promote other people’s products and services and earn a commission for each sale you refer. It is a beginner-friendly way to generate passive income. While it requires some upfront effort, the potential rewards can be significant. Just remember, success comes from building trust and offering genuine value to your audience.

4.1 Basic Knowledge Needed

Low. You don’t need any coding skills or technical expertise, just the ability to create engaging content and understand your audience.

4.2 Initial Investment:

Very Low. You’ll need a platform to promote the products, which could be a blog, social media account, or even an email list. Free options are readily available, but paid plans may offer additional features.

4.3 Time to Income

Variable. It can take time to build an audience and trust. Be prepared to put in the effort upfront for content creation and audience engagement. Consistency is key. Some affiliates see results quickly, while others take months or even a year to see a steady income stream.

4.4 Pros

- Passive Income: Once your content is live, it can continue to generate income for you even while you sleep (or work on other projects).

- Low Barrier to Entry: Just by acquiring the knowledge needed to launch a platform and attract an audience for affiliate marketing, you are good to go.

- Scalability: Your earning potential grows with your audience.

- Variety of Niches: Promote products relevant to your existing audience and interests.

4.5 Cons

- Reliant on Others: While your income is influenced by the affiliate program and product, you have control over which programs you join.

- Competition: The affiliate marketing space is competitive, but there’s room for everyone by niching down to a specific audience and becoming an authority in that area.

- Requires Consistent Effort: Building an audience and trust takes time, but much of the effort can be front-loaded.

- Disclosure Requirements: Disclosing affiliate links is a legal requirement, but it can also be an opportunity to build trust with your audience.

4.6 Verdict

Affiliate marketing is an attractive option for passive income because it’s beginner-friendly and scalable. You don’t need a lot of money to start, and once you create content promoting products you like, it can keep generating income even when you’re not working. With some initial effort, affiliate marketing can be a great way to earn online passive income.

The Affiliate Marketing Success Story of Matt Giovanisci

Many successful affiliate marketers come from surprising backgrounds. Today, we delve into the journey of Matt Giovanisci, who went from working at a pool company to building a thriving affiliate marketing empire.

Learning the Ropes: From Pool Care to Content Creation

Matt Giovanisci’s story starts, not in the digital world, but poolside. For years, he honed his expertise working for a pool maintenance company. This experience proved invaluable when he decided to leap into affiliate marketing.

Building a Niche: Swim University and the Power of Content

Matt Giovanisci’s first venture was “Swim University,” a website dedicated to all things pool care. Recognizing the vast amount of online searches for pool-related topics, he built a website crammed with valuable content for pool owners. Imagine landing on “Swim University” and finding comprehensive guides like “How to Clean a Green Pool,” “Pool Chemicals Guide,” and “Pool Maintenance Tips.” This valuable information not only established Matt Giovanisci as a reliable source in the pool care niche but also positioned him perfectly to promote affiliate products.

Expanding Horizons: The Birth of Money LAB

Matt Giovanisci wasn’t content with just one successful website. In 2016, he set his sights on building a platform for broader affiliate marketing ventures: “Money LAB.” Here, his ambition wasn’t just about income – it was about building brands, exploring diverse niches, and even indulging in his passion for homebrewing (a topic you might have found on Money LAB!).

The Money LAB Rules: A Recipe for Success

Matt Giovanisci’s approach to Money LAB was unique. He built his brand on four core principles, inspired by the classic cartoon “Road Runner Rules”:

- Have Fun and Entertain Your Audience: Affiliate marketing shouldn’t feel like a chore. Matt Giovanisci prioritized creating engaging content that keeps them coming back for more. Matt Giovanisci injected humor and personality into his content wherever it fits.

- Honesty is the Best Policy: Building trust is paramount. Matt Giovanisci ensured his recommendations were genuine and valuable to his readers.

- Challenge the Status Quo: Don’t be afraid to break from the mold. Matt Giovanisci sought unconventional approaches to stand out in a crowded marketplace.

Roasty and the Diverse Landscape of Affiliate Marketing

Matt Giovanisci’s journey wasn’t limited to pool care. In March 2015, he ventured into the world of coffee with “Roasty,” a website dedicated to coffee education (though it’s no longer under his ownership). Imagine browsing “Roasty” and finding in-depth reviews on “Best Coffee Makers” or guides on “Coffee Brewing Techniques.” This further exemplifies Matt Giovanisci’s ability to identify profitable niches and build targeted affiliate marketing campaigns.

The Takeaway: Persistence, Content, and Passion Fuel Affiliate Marketing Success

Matt Giovanisci’s story is an inspiration to aspiring affiliate marketers. It wasn’t an overnight success, but a result of hard work, dedication, and a passion for creating valuable content. He identified a niche, built trust with his audience, and constantly explored new avenues.

Remember, affiliate marketing is a marathon, not a sprint. By following Matt Giovanisci’s example, you too can build a sustainable and rewarding online business.

Building Your Path to Passive Income

This blog post has hopefully given you a clear understanding of passive income, its potential benefits, and a realistic perspective on the effort involved. You’ve also explored some of the most popular methods and even seen a real-life success story with affiliate marketing.

Affiliate marketing has proved itself as the best online passive income method. It offers low barriers to entry, requires minimal upfront investment, and allows you to leverage established brands and products.

Ready to dive into the world of affiliate marketing? MaxMart has your back! Their comprehensive guide, linked under each step below, will walk you through the entire process:

- Affiliate Marketing Explained: Grasp the fundamentals of affiliate marketing and how it works.

- Choosing Your Affiliate Niche: Discover your area of expertise and passion to target the right audience.

- Understanding Affiliate Marketing Programs & Networks: Learn where to find relevant affiliate programs and leverage networks for wider reach.

- Driving Traffic for Affiliate Marketing: Explore strategies to attract potential customers to your recommendations.

- Calculating Affiliate Marketing ROI and Optimizing Conversion: Track your results, measure success, and refine your approach to maximize conversions.

Clicking on each step will take you to a dedicated resource within MaxMart’s guide. Remember, success takes time and dedication, but with the right approach and commitment, you can turn your passion into a rewarding income stream.

Conclusion

In conclusion, passive income offers an enticing path to financial freedom, but it’s essential to approach it with realistic expectations. Whether you’re considering rental properties, dividend-paying stocks, digital products, or affiliate marketing, each method requires an initial investment of time, effort, and sometimes capital. However, the rewards can be significant, providing a steady income stream that supports your financial goals.

Among the various options, affiliate marketing stands out as a particularly accessible and scalable method, especially for beginners. With minimal upfront costs and the potential for significant returns, it’s an ideal starting point for those looking to dip their toes into the world of passive income. By learning from successful examples like Matt Giovanisci, who turned his niche expertise into a thriving business, you can build a sustainable and rewarding passive income stream.

Remember, the journey to financial independence through passive income is a marathon, not a sprint. Stay patient, keep learning, and continue refining your strategies. With dedication and persistence, you can create a robust passive income portfolio that brings you closer to achieving your financial dreams.

Learning Center and become a master of affiliate marketing

Learning Center and become a master of affiliate marketing